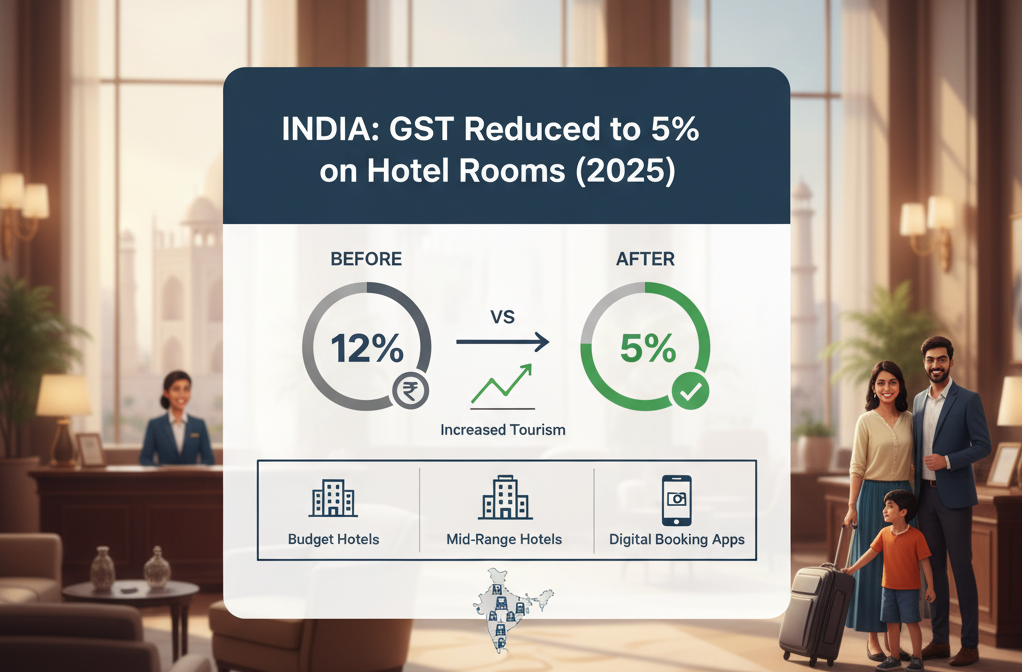

India’s hospitality sector has undergone a major tax restructuring with the government’s decision to reduce GST on hotel rooms priced up to ₹7,500 to just 5%. This bold move is part of the broader GST rationalization intended to stimulate domestic tourism, make hotel stays more affordable, and bring greater clarity to the tax framework.

Before this reform, hotel rooms within the same tariff range attracted 12% GST with Input Tax Credit (ITC). Under the new structure, these rooms now fall under the 5% GST slab without ITC, making hotel stays cheaper for guests while altering cost structures for hoteliers.

https://saasaro.

What is a Revenue Management System and Why Hotels Need It?

A Revenue Management System (RMS) is a smart hotel technology tool that uses data, automation, and analytics to help hotels set the right price at the right time. It analyzes market demand, competitor pricing, booking trends, and occupancy forecasts to recommend the most profitable room rates. Hotels use RMS software to improve hotel revenue management, optimize pricing, and boost overall profitability.

Hotels need a Revenue Management System because the hospitality industry is highly competitive and demand changes quickly. https://saasaro.com/blog/what-is-a-rev

Saasaro’s Revenue Management System is a game-changer for hoteliers seeking to maximize profitability through smart, data-driven strategies. By leveraging pricing optimization, demand forecasting, and comprehensive analytics, Saasaro helps you supercharge your hotel’s revenue streams while staying ahead of market competition.

At the heart of Saasaro’s revenue management offering is an advanced algorithm that evaluates market demand, competitor rates, and historical booking data. This enables dynamic pricing — ensuring your rooms are always priced competitively, yet profitably. https://saasaro.com/revenue-management.php